When was the last time you sat down to think about money and finances? Maybe it’s something you do at the end of every month, or week, or when planning for big purchases like a house, a new car or a significant investment. Maybe you’re a business owner and you’re confronted with numbers and figures on the daily. Or, maybe, sitting down in the company of your bank statements is something you dread and avoid all-together. Money is always a funny subject, isn’t it? Some friends will tell you how much they earn in the same breath as anecdotes regarding their last Hinge date while others will skirt around the subject muttering about ambitions to buy a house ‘someday’ and resort to the difficulty of getting on the property ladder in search of safe conversational terrain.

This week, we will be concentrating on, well, money. Finances and, in particular, women’s finances, have always been topics close to our hearts. In light of current events, money anxiety is, predictably at an all time high, with an ONS survey suggesting that 8.6 million people in their UK have seen their income fall. According to the survey, women reported greater anxiety levels to men at a concerning 24% higher. This is unsurprising perhaps when considering that women are most likely to resort to flexible working when juggling childcare (or cease working all-together), may be in lower paid jobs or out of the work-force for periods of time for a wide range of reasons.

The questions we are asking ourselves, are probably the questions you are asking yourselves too so we are delighted to be focusing on financial resources entirely this week. From interviews with industry experts to useful tools for freelancers and clever money hacks (because money can be fun too!) we hope you learn with us this week, have fun and utilise this opportunity (and any extra time you may have during lockdown) to take a look at your finances. To kickstart the week, as it’s only a Monday and we’re not ready for pension-funds or investment coffee-break chat, we thought we would share three easy resources we can’t get enough of when it comes to spending our hard-earned cash…..

The Website – From career-advice to travel and recipes which don’t always include the dreaded meal-prepping advice, we love The Financial Diet for easy, straightforward money tips and tricks. The first-person stories are great, the no-judgement tone is probably what attracts and retains such a loyal following but, to be honest, our favourites are their Instagram challenges and daily check-ins. Yes, we don’t need to go to that third expensive drinks ‘catch-up’ this week and yes, we can totally create a cute drinks-trolley for under £100 without spending an entire check in Oliver Bonas. Thank you, The Financial Diet.

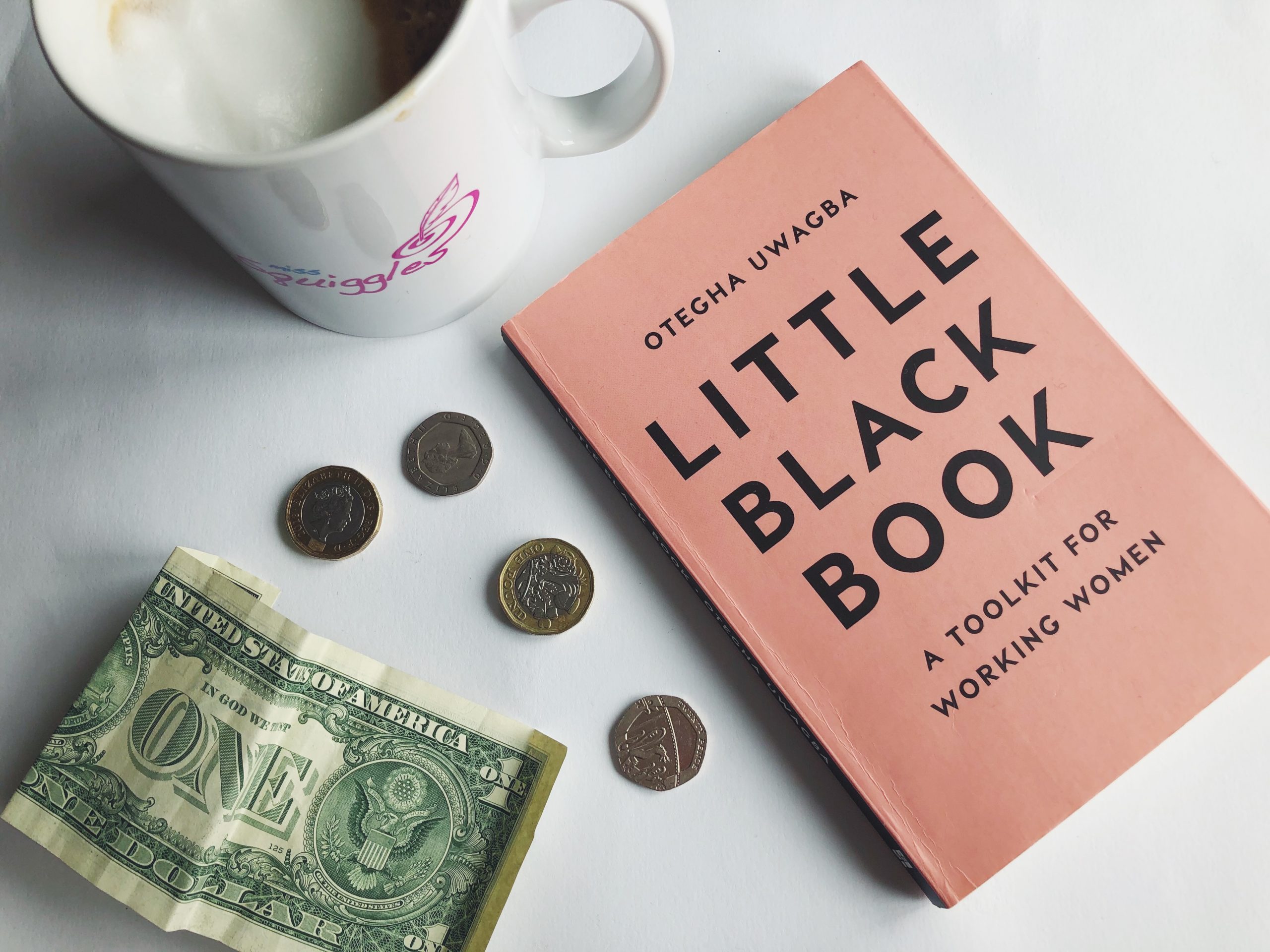

The Book – As any self-employed individual will tell you, the feeling of a late payment, delays in being signed up for the payroll at any publication or constant DMs asking to ‘pick your brain’ are an all-too regular an occurrence. We have loved the Little Black Book by Otegha Uwagba so much that, four years on, we continue to gift it to friends irrespective of their job titles, industry or experience. Chapter 5 and 6 on Money Talks are absolute gold. If you need to take care of your business, get round to some invoicing you have been putting off or need to establish professional boundaries, you definitely need to pick this up if only for the Freelancers Finances tips – utterly brilliant and no free work over a coffee in sight.

The Networking Event – When it comes to money, having the right habits, mindset and support network is crucial. Think about it – how many times did you feel like you had to buy that round? Or felt guilty about turning down an expensive girls weekend? Or turned down an opportunity to go freelance / do what you love because of uncertainty related to money? We love EMpowerME Sisters ‘s mindset around lifestyle and career and will be signing up for their first online event here. This particular event is in collaboration with the lovely ladies from Complete Confidence Makeover which we interviewed last week and we are looking forward to finding out about their career journeys.

What are your favourite money resources – the book that changed your mindset, the app that made saving easy or the account you recommend to everyone? Let us know! We hope you enjoy these features this week and utilise them as an opportunity to take a deep breath, face whatever money fears you have been avoiding and plan for the future you want and deserve.

Love,

The Squiggles Team X